For 5 years, Lunio has been protecting digital marketers from click fraud and invalid PPC activity.

A big part of what we do comes from speaking to PPC professionals, like you, on the frontline of PPC marketing. Listening to your thoughts and opinions and understanding the challenges you face on a daily basis.

This info helps us continue to innovate in the fight against digital ad fraud.

That’s why, in partnership with several other marketing technology companies, we recently conducted the largest survey on the current state of the PPC landscape ever done.

Over 540 industry professionals took part in helping evaluate the state of PPC in 2022.

Read on to see what they had to say.

Google’s Role In Click Fraud Prevention

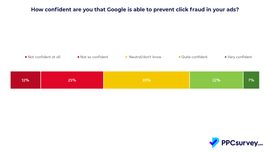

The first thing we wanted to gauge was marketer confidence in Google, namely, how confident they were that Google could prevent click fraud in their ads.

This question polarized opinions across the board with over 72% lacking confidence on Google’s capabilities to mitigate ad fraud.

(Interestingly, EMEA specialists, at 3%, had the lowest rate of “very confident” responses, and are evidently much less trusting of Google’s click fraud detection than their American counterparts (15%).

What’s behind this divide in opinion about Google’s ability to prevent click fraud?

We believe it may be down to a genuine lack of awareness around the issue. Our Global Invalid Clicks Report 2021 discusses this problem in more detail. If that’s something you’d like to understand a bit more about, we’d recommend taking a look.

Click Fraud Prevention – Awareness

If respondents answered “very confident,” we asked no further questions about click fraud solutions because they’re beyond help.

No, just kidding! We decided to focus this particular question on those that answered “unsure” or “not confident”.

The findings were surprising.

In answer to the question, “Which click fraud prevention solution(s) do you use?” a massive 74% said they aren’t using any. Even though they admitted they weren’t very confident in Google’s ability to prevent click fraud in their ads.

Why not?

- They don’t believe they have a click fraud problem (32%)

- They don’t have the bandwidth to evaluate (20%)

- They don’t spend enough to warrant it (15%)

Whilst we can only speculate on the reasons behind the reasons, so to speak, perhaps click fraud prevention is less of a priority than the metrics by which marketers inevitably judge results – sales and revenue.

The fact is that up to 80% of the cost of online ads is discarded as ‘the price of doing business’. For marketers with little time to concentrate on anything other than conversion, click-through and revenue metrics, and with most acquisition campaigns delivering a satisfactory ROAS, this cost of doing business seems to be accepted (we don’t agree with this!).

In addition, accepting the cost of business means an unknowing acceptance of the profiteering taking place at the expense of company marketing budgets.

Spend By Advertising Channel

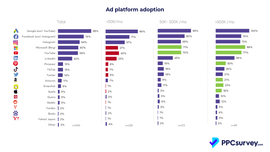

Another area of interest in the report is the spread of ad spend across acquisition media channels.

When asked, “On which platforms are you (or is your team) currently running PPC campaigns?”, we saw the following results:

The percentages in the chart above simply indicate how often a platform was part of the advertising mix, not necessarily the relative spend on that platform. To learn more about the spend on the main networks, check out the main PPC 2022 report.

It won’t come as a surprise that Google and Facebook are number one and two on the list. But drilling down into the advertising mix and segmenting it by monthly spend under management suddenly makes it more interesting.

Google, Facebook and Instagram are the ‘go-to’s’ for companies with budgets of $50k or less per month. Where the budget is significantly higher, though, such as between $50k and $500k, Microsoft and YouTube appear to have a larger focus.

Above $500k and adoption seems to be more evenly spread across the full repertoire of platforms, although Microsoft beats Facebook AND YouTube in the race for second place (behind Google).

It’s really interesting to see the current state of PPC from the perspective of professionals within the industry. These fascinating insights are based around just one part of our 50-page report. To learn more about the state of Pay-Per-Click Advertising in 2022, grab the full report here.

Stay tuned for more Report Highlights in our blog coming soon!