In a previous blog we unpacked some of the findings from our largest ever survey on the state of PPC, specifically focusing on the potential threats to digital advertising.

The report analysed 540 responses from brands, agencies, and contractors around the world. Most respondents were PPC professionals, with a skew towards the EMEA and US markets.

In this post, we’ll take a closer look at what the survey revealed about the state of PPC marketing within brands.

Ad Platform Adoption & Spend

One particular area of interest in the report is the spread of ad spend across different platforms and channels.

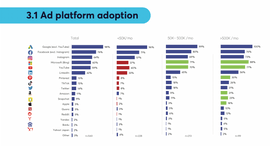

We asked, “On which platforms are you (or your team) currently running PPC campaigns?” and the following graph outlines the response:

(Note: We didn’t ask for the distribution of spend across these platforms, so the percentages in the chart above simply indicate how often a platform was part of the advertising mix, not necessarily the relative spend on that platform. To learn more about the spend on the main networks, download the full report.)

It won’t come as any surprise that Google and Facebook are number one and two on the list. But drilling down into the advertising mix and segmenting it by budget suddenly makes it more interesting.

Google, Facebook, and Instagram are the clear favourites for companies with budgets of $50k or less per month. But for brands with a budget between $50k and $500k, Microsoft and YouTube adoption both increase to put them on an equal footing with Instagram and Facebook.

Looking at those businesses with above $500k in monthly ad spend, platform adoption seems to be more diversely spread across the full repertoire of options, although Microsoft adoption beats Facebook and YouTube in the race for second place (behind Google).

We also asked participants to let us know their team size and the monthly spend under management. This enabled us to find out how much PPC spend one person manages on average. In summary, we found that:

- As monthly spend increases, so does the efficiency per employee with economies of scale kicking in as budgets and team size increase.

- Advertiser PPC managers are more efficient than their agency counterparts.

- Once the total monthly spend exceeds $1m, each employee manages a monthly spend of at least $200k

PPC Specialist Short-Term Priorities

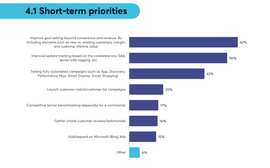

To drill down into what the specific priorities of PPC marketers are, we asked the 246 freelancers and PPC specialists that took part in the survey what their (or their client’s) top priorities are for the coming months.

And there were three clear winners:

- Improve goal setting beyond conversions and revenue by including elements such as new vs. existing customers, margin, and customer lifetime value (62%);

- Improve/update tracking based on the cookieless era, GA4, server-side tagging, etc. (56%);

- Test fully automated campaigns (such as Performance Max, Smart Display, App campaigns, Discovery campaigns) (43%).

The foundations of optimal measurement and goal setting remain a top priority. But the report also indicated that most campaigns are still steered on efficiency metrics like ROAS and CPA, not on profit-based metrics. This means that many advertisers and brands still have a lot of work to do when it comes to measuring the added value their campaigns deliver.

Use of Third-Party Technology

Next to Google’s built-in automation, we also asked PPC specialists about the additional software they’re using for things like project management, reporting, optimization, and click fraud.

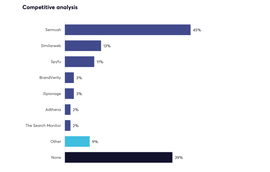

There were lots of software categories in this part of the survey, so we’ve pulled out one which contained a particularly surprising result. And that was in Competitive Analysis tools.

Search giant Semrush tops the list in this category, followed by Similarweb. Spyfu was third – and with their focus on English-speaking countries, it wasn’t surprising to see such a huge difference in usage between EMEA (4%) and North Americas (37%) respondents.

But what did surprise us was that 39% of specialists are not using any of these tools. Which means they’ll be relying on Auction Insights and Googling important keywords for competitive insights. We just hope they use the ad preview and diagnosis tool!

Other Topics Covered in the Full Report

We mentioned at the outset that this was the most comprehensive report we’ve ever done on the state of PPC. And after two highlight summaries, there’s still loads left to check out. Download the full report to learn more about how PPC professionals are responding to:

- The adoption and satisfaction of Google Ads automation (inc. PMax)

- Click fraud

- Budget pacing

- AI writing assistants

- Time-consuming activities

The third and final instalment of our PPC report highlight series will focus specifically on agencies – so stay tuned!